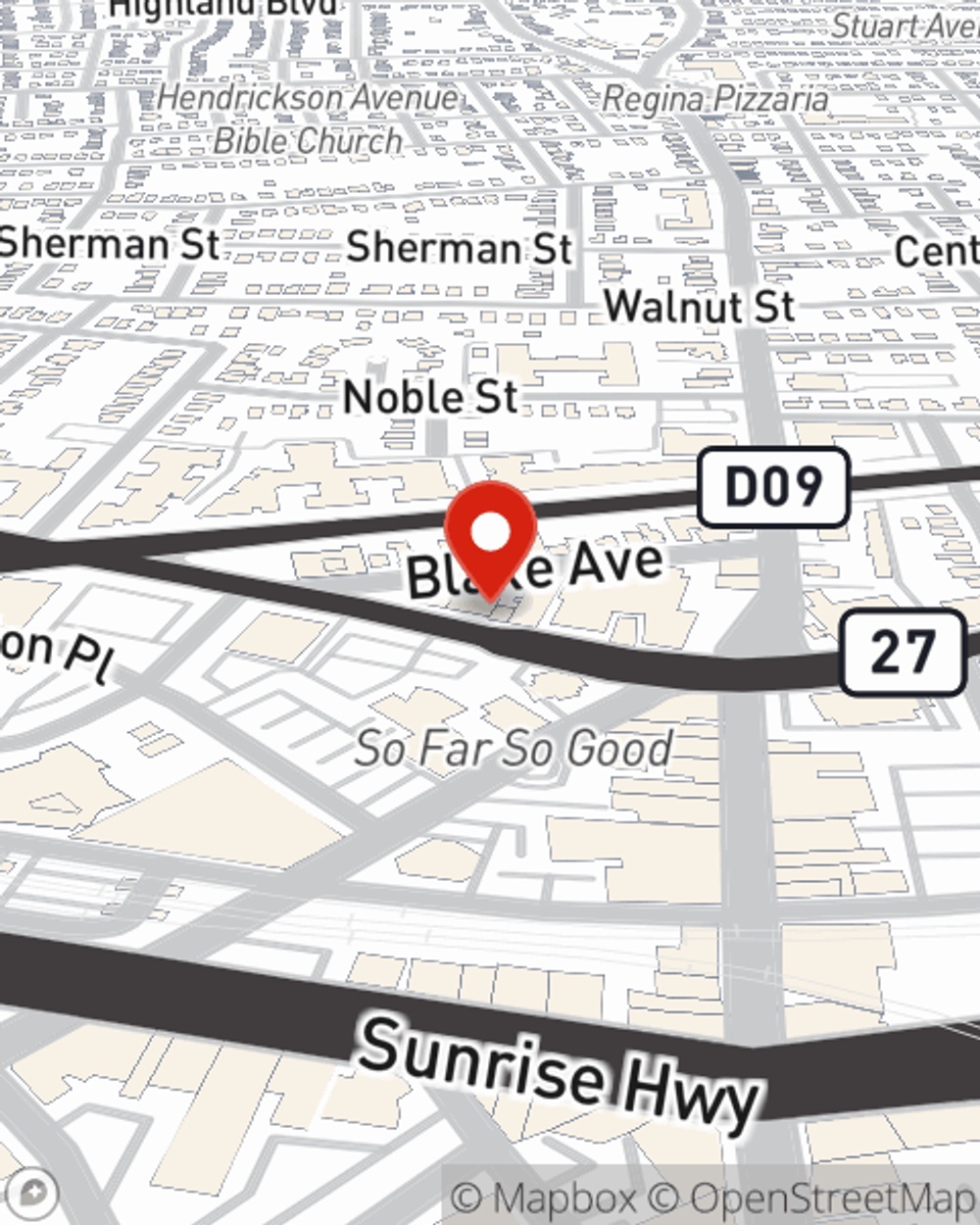

Business Insurance in and around Lynbrook

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Insure The Business You've Built.

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, business continuity plans and errors and omissions liability, among others.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a HVAC company, a dry cleaner, or a juice store, having the right coverage for you is important. As a business owner, as well, State Farm agent Peter Kelly understands and is happy to offer exceptional service to fit your needs.

Agent Peter Kelly is here to discuss your business insurance options with you. Call or email Peter Kelly today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Peter Kelly

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.